Personal Finance

KiwiSaver members withdrew over $143 million in early withdrawals in January, marking the highest January amount on record

3rd Mar 25, 2:49pm

1

KiwiSaver members withdrew over $143 million in early withdrawals in January, marking the highest January amount on record

Latest RBNZ figures show non-performing housing loans rose $165 million in January - the biggest monthly surge since June 2020 during the pandemic

3rd Mar 25, 10:59am

18

Latest RBNZ figures show non-performing housing loans rose $165 million in January - the biggest monthly surge since June 2020 during the pandemic

Latest Reserve Bank figures show investors took 22.5% of the committed mortgage money in January - the highest percentage they've claimed since February 2021

27th Feb 25, 4:06pm

38

Latest Reserve Bank figures show investors took 22.5% of the committed mortgage money in January - the highest percentage they've claimed since February 2021

Treasury reduces Kiwi Bond interest rates, the benchmark for risk-free saving for retail savers, their second cut in 2025

27th Feb 25, 2:00pm

Treasury reduces Kiwi Bond interest rates, the benchmark for risk-free saving for retail savers, their second cut in 2025

Scam Factories: the inside story of Southeast Asia’s brutal fraud compounds

Economic abuse is on the rise. Lynda Moore offers some guidance, strategies and links to where you can get help

26th Feb 25, 8:04am

10

Economic abuse is on the rise. Lynda Moore offers some guidance, strategies and links to where you can get help

More mortgage rate cuts by more banks shifts who has the lowest rates, as banks jockey for position in a very competitive marketplace because new loan growth is quite limited

25th Feb 25, 8:42am

40

More mortgage rate cuts by more banks shifts who has the lowest rates, as banks jockey for position in a very competitive marketplace because new loan growth is quite limited

[updated]

Another week, more term deposit rate cuts led by some large & some challenger banks. The arrival of sub-4% rates spread, and rate inversions narrow

24th Feb 25, 11:22am

7

Another week, more term deposit rate cuts led by some large & some challenger banks. The arrival of sub-4% rates spread, and rate inversions narrow

[updated]

ASB matches the new lower ANZ two year mortgage rates, and launches a low one year fixed rate (although not as low as Kiwibank). Now Westpac has cut too

24th Feb 25, 8:46am

35

ASB matches the new lower ANZ two year mortgage rates, and launches a low one year fixed rate (although not as low as Kiwibank). Now Westpac has cut too

Lynda Moore says your mindset around money is one of the most powerful tools in your business. When you shift from fear to confidence, from scarcity to abundance, you open the door to new opportunities

22nd Feb 25, 10:01am

2

Lynda Moore says your mindset around money is one of the most powerful tools in your business. When you shift from fear to confidence, from scarcity to abundance, you open the door to new opportunities

UK inheritance tax changes designed to grab tax from thousands of returning Kiwis and Brits is coming down-under

22nd Feb 25, 9:21am

5

UK inheritance tax changes designed to grab tax from thousands of returning Kiwis and Brits is coming down-under

We explore how the Deposit Compensation Scheme could allow savers to earn more term deposit interest by spreading investments among the covered institutions. The result: better than main bank returns

22nd Feb 25, 9:03am

1

We explore how the Deposit Compensation Scheme could allow savers to earn more term deposit interest by spreading investments among the covered institutions. The result: better than main bank returns

Kiwibank has jumped to the head of the queue with its latest fixed home loan offers, targeting the most popular terms at the short end

21st Feb 25, 10:31am

23

Kiwibank has jumped to the head of the queue with its latest fixed home loan offers, targeting the most popular terms at the short end

Statistics NZ says people have been spending a higher proportion of their money on housing costs than they did in the past

20th Feb 25, 12:03pm

45

Statistics NZ says people have been spending a higher proportion of their money on housing costs than they did in the past

[updated]

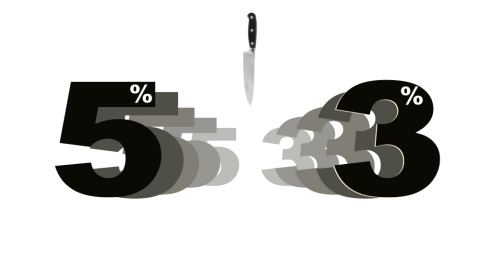

The ground is about to sink faster for savers. ANZ brings back a TD rate starting with a '3', and now only one bank offers a rate starting with a '5'

20th Feb 25, 9:12am

23

The ground is about to sink faster for savers. ANZ brings back a TD rate starting with a '3', and now only one bank offers a rate starting with a '5'

The Red Bank pulls away from its sub 5% rate offer, but ANZ then jumped in with a 4.99% two year fixed carded offer

19th Feb 25, 3:07pm

49

The Red Bank pulls away from its sub 5% rate offer, but ANZ then jumped in with a 4.99% two year fixed carded offer

Banks quick out of the blocks with cuts to floating home loan rates - and they are also cutting savings account rates at the same time

19th Feb 25, 2:05pm

56

Banks quick out of the blocks with cuts to floating home loan rates - and they are also cutting savings account rates at the same time

The latest quarterly Household Expectations Survey for the Reserve Bank finds that households reckon the inflation rate will be 4.9% in a year and they don't see it being within the 1% to 3% target range over the next five years

18th Feb 25, 3:43pm

43

The latest quarterly Household Expectations Survey for the Reserve Bank finds that households reckon the inflation rate will be 4.9% in a year and they don't see it being within the 1% to 3% target range over the next five years

[updated]

TSB shines with a pre-RBNZ rate drop for fixed home loan rates, with their one year rate at a market leading level not seen since May 2023 from any other bank

18th Feb 25, 8:43am

13

TSB shines with a pre-RBNZ rate drop for fixed home loan rates, with their one year rate at a market leading level not seen since May 2023 from any other bank

Lynda Moore says the money conversation is about more than just dollars and cents - it’s about building trust, understanding, and a shared vision for the future

13th Feb 25, 9:23am

Lynda Moore says the money conversation is about more than just dollars and cents - it’s about building trust, understanding, and a shared vision for the future

Latest monthly RBNZ figures show sharp drops in what customers were paying on new mortgage rates in the second half of last year - but the bank yields on existing mortgages are falling only very slightly

12th Feb 25, 9:00am

4

Latest monthly RBNZ figures show sharp drops in what customers were paying on new mortgage rates in the second half of last year - but the bank yields on existing mortgages are falling only very slightly

ASB cuts its fixed mortgage rates to market lows, and cuts term deposit rates even harder, in moves much larger than wholesale rate changes

12th Feb 25, 8:29am

109

ASB cuts its fixed mortgage rates to market lows, and cuts term deposit rates even harder, in moves much larger than wholesale rate changes

Latest monthly RBNZ figures show that in December the very brief flirtation with floating rate mortgages was replaced by a surge of interest in six month fixed rates

10th Feb 25, 3:47pm

7

Latest monthly RBNZ figures show that in December the very brief flirtation with floating rate mortgages was replaced by a surge of interest in six month fixed rates

Banks continue tweaking their term deposit offers with Kiwibank (down & up), and BNZ (down) the latest to move. These changes leave ANZ top of that main bank heap with its six month offer

10th Feb 25, 10:53am

45

Banks continue tweaking their term deposit offers with Kiwibank (down & up), and BNZ (down) the latest to move. These changes leave ANZ top of that main bank heap with its six month offer

Gold demand hits new records in 2024, and that was before the 2025 jump. Central banks and investors drove the 2024 market strength

9th Feb 25, 12:14pm

2

Gold demand hits new records in 2024, and that was before the 2025 jump. Central banks and investors drove the 2024 market strength